What is Fintech?

Fintech (Financial Technology) is a term referring to technological solutions applied to the financial and banking sectors to optimize transactions, payments, lending, asset management, investment, or the operation of other financial services.

In Vietnam, Fintech is developing strongly in popular areas such as:

- Electronic payments, e-wallets.

- Digital bank.

- Peer-to-peer lending.

- eKYC solution, credit scoring using technology.

- Blockchain solutions, digital assets (subject to current legal restrictions).

However, Each Fintech model has a different level of regulation., depending on the scope of adjustment of Vietnamese law.

The current legal framework for Fintech in Vietnam

Currently Vietnam There is no specific law for Fintech yet.. Instead, the Fintech ecosystem is regulated by a complex network of existing legal documents and specialized regulations. Below are the main groups of regulations currently in effect:

1. Fintech in the payment sector

- Law on Credit Institutions.

- Decrees and circulars of the State Bank of Vietnam (SBV) on payment intermediary activities, e-wallets, and cashless payments.

Sectors such as e-wallets, electronic payment gateways, and money transfers are strictly regulated and require a license or registration in accordance with the State Bank of Vietnam's regulations.

2. eKYC and electronic identification

- State Bank of Vietnam regulations on opening payment accounts electronically.

- Decree on electronic identification and authentication for businesses applying eKYC.

The legal framework for eKYC is gradually being finalized, and businesses must ensure compliance with technical standards and data security.

3. Peer-to-peer lending (P2P Lending)

Currently Vietnam There are no specific legal regulations for P2P lending.. The government is studying the development of a regulatory sandbox, so businesses operating in this area need to:

- Develop a transparent model,

- No representative receiving money – lending like a credit institution,

- No profit guarantee,

- Do not operate in violation of credit regulations.

4. Blockchain technology – digital assets

Vietnamese law Cryptocurrency, tokens, or digital assets are not recognized as legal tender.. Some blockchain applications outside the scope of payments (traceability, distributed data, etc.) can still be implemented if they do not violate the law.

5. Fintech Pilot Program (Sandbox)

The government has demonstrated its commitment to building controlled testing mechanism (sandbox) in certain areas of Fintech. However, This mechanism has not yet been fully implemented., Therefore, businesses can only refer to general guidelines and prepare documentation and models in advance when the government implements them.

See more: Detailed Guide to Registering for the Sandbox Testing Mechanism

Opportunities and Challenges for Fintech in Vietnam

1. Opportunity

- The consumer finance market is growing strongly.

- High percentage of Internet and smartphone users.

- The government promotes digital transformation and cashless payments.

- The need to expand financial services in underserved areas.

2. Challenges

- The legal framework is incomplete for many models.

- High compliance requirements for data security and safety.

- Risk of being considered “illegal business” if engaging in unlawful activities but there are no clear laws regulating them.

- Pressure to demonstrate technology, transparent operating models, and anti-money laundering measures.

Having in-depth legal advice is a mandatory requirement. to enable Fintech companies to operate safely and sustainably.

See more: In-Depth Legal Consulting Services on Digital Assets

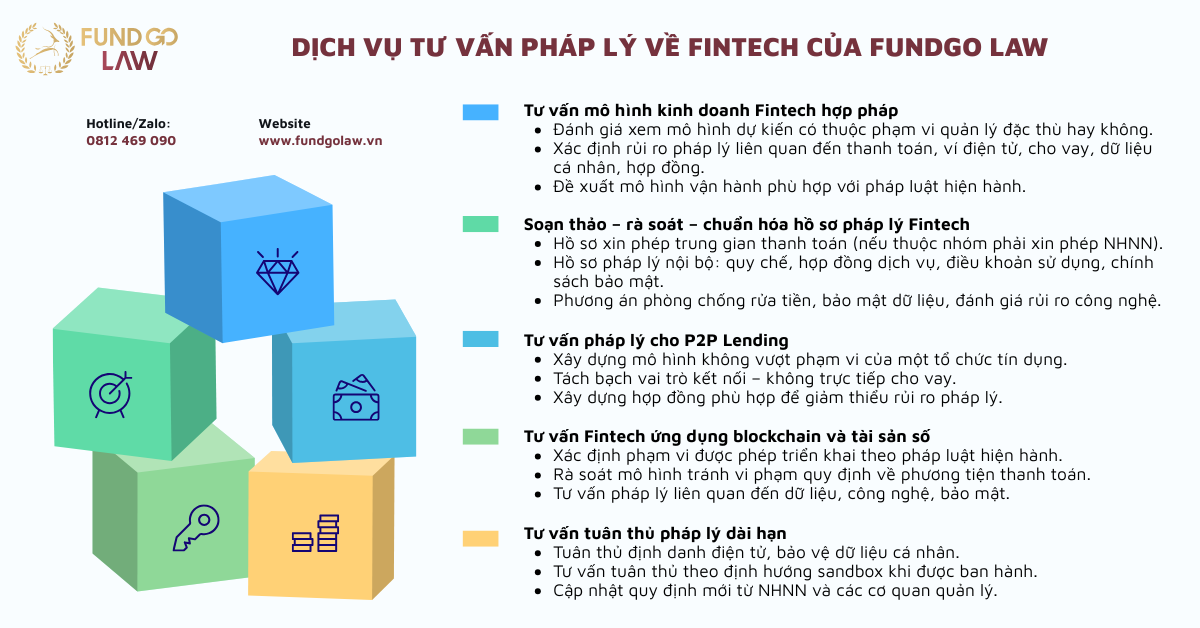

How does Fundgo Law provide legal advice on Fintech?

1. Legal advice on Fintech

- Assess whether the proposed model falls within the scope of special management.

- Identify legal risks related to payments, e-wallets, lending, personal data, and contracts.

- Propose an operating model that complies with current laws.

2. Drafting – reviewing – standardizing Fintech legal documents

- Intermediary payment license application (if subject to SBV licensing).

- Internal legal documents: regulations, service agreements, terms of use, privacy policies.

- Anti-money laundering measures, data security, technology risk assessment.

3. Legal advice for P2P Lending

Since P2P lending does not yet have its own specific laws, Fundgo Law will provide support:

- Develop a model that does not exceed the scope of a credit institution.

- Separate the role of connection – no direct lending.

- Draft appropriate contracts to minimize legal risks.

4. Legal advice on Fintech applications of blockchain and digital assets

- Determine the scope permitted for implementation under current law.

- Review the model to avoid violating regulations on payment instruments.

- Legal advice related to data, technology, and security.

5. Long-term legal compliance consulting on Fintech

- Comply with electronic identification and protect personal data.

- Provide compliance advice in accordance with the sandbox approach when it is issued.

- Updates on new regulations from the State Bank of Vietnam and regulatory agencies.

Why Fundgo Law is the top choice for Fintech companies

- Deep expertise in Fintech legal matters – technology – finance.

- Real-world experience in projects: e-wallets, electronic payments, P2P lending, blockchain, digital banking.

- Be well-versed in Vietnamese law and the latest management guidelines.

- Full-service support, from model design to operation and compliance.

- Team of lawyers – technology experts with in-depth knowledge of Fintech products and market specifics.

Fundgo Law partners with individuals and Fintech companies to build business models. legal – safe – sustainable, helping to minimize legal risks in a context where regulations are still being finalized.