Da Nang is emerging as Vietnam's center for entrepreneurship and innovation. It is a place where technology companies, startups, and SMEs have the opportunity to grow rapidly thanks to the outstanding incentives offered by Resolution 53/2024/NQ-HĐND.

When registering as an innovative enterprise, businesses are not only exempted or granted reductions in corporate income tax, but also receive support in the form of capital, workspace, intellectual property consulting, and connections to investment funds. This is an important stepping stone that helps young businesses save costs, expand their market, and quickly commercialize their innovative products.

Fundgo Law provides comprehensive innovative business registration services in Da Nang. Support ranges from advising on requirements, preparing documents, representing clients before government agencies, to guiding clients on how to take advantage of tax incentives.

Resolution 53/2024/NQ-HĐND – Legal basis for promoting innovation

Resolution 53/2024/NQ-HĐND was issued to develop an innovation ecosystem in Da Nang, encouraging businesses to apply new technologies and create breakthrough products and business models.

Applicable entities: Enterprises engaged in research and development of technology products or application of innovative solutions in production and business; start-ups with new business models and high commercialization potential.

See more: Service for Applying for a Science & Technology Enterprise Certificate

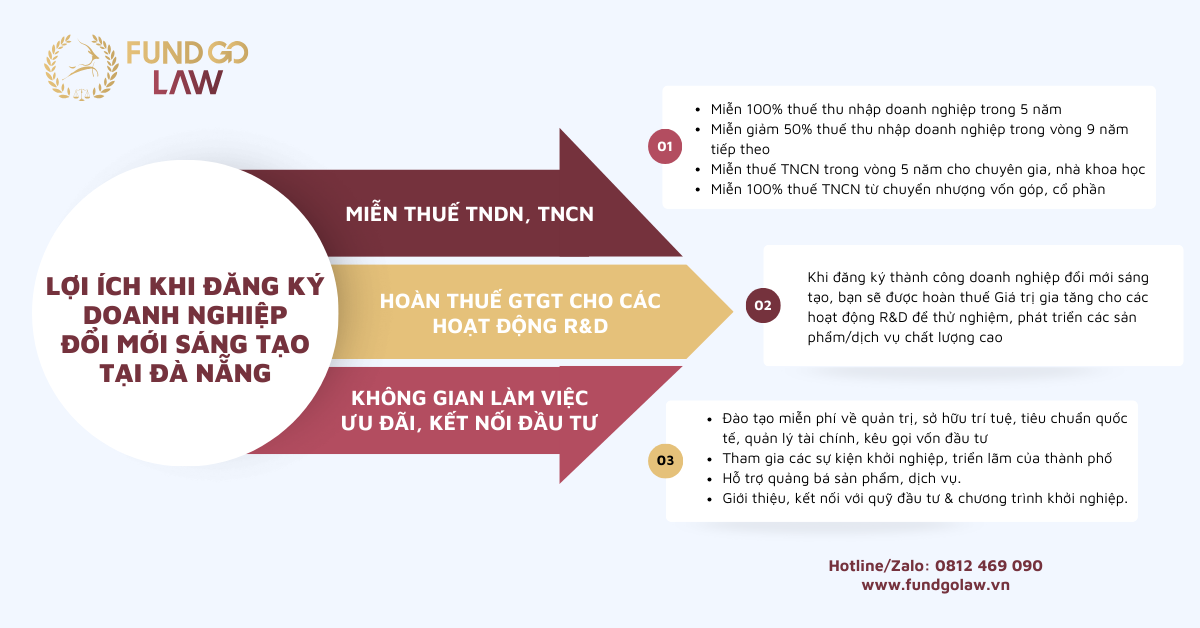

Benefits of registering an innovative business in Da Nang

Resolution 53/2024/NQ-HĐND is a new milestone that creates favorable conditions for startups to break through with a series of unprecedented attractive incentives.

Corporate income tax exemption, personal income tax exemption

- Exempt 100% corporate income tax for 5 years from the date the tax liability arises.

- Corporate income tax exemption for 50% for the next 9 years.

- Exempt from business registration fees for the first three years from the date of issuance of the Business Registration Certificate.

- Exempt from personal income tax for 5 years on income from salaries and wages in the field of innovation and creativity for experts, scientists, talented individuals, and individuals with employment contracts related to innovation and creativity activities.

- Exempt 100% income tax from the transfer of capital contributions and shares.

VAT refund for R&D activities

Upon successful registration as an innovative enterprise, you will receive a Value Added Tax refund for R&D activities aimed at testing and developing high-quality products/services.

Preferred workspace, investment connections

- Provide free training courses on management, intellectual property, international standards, financial management, and fundraising.

- Free admission to startup events and innovation exhibitions in the city.

- Support product and service promotion.

- Prioritize introductions and connections with investment funds and startup acceleration programs.

See more: Professional Outsourced Legal Services for Start-Up Businesses

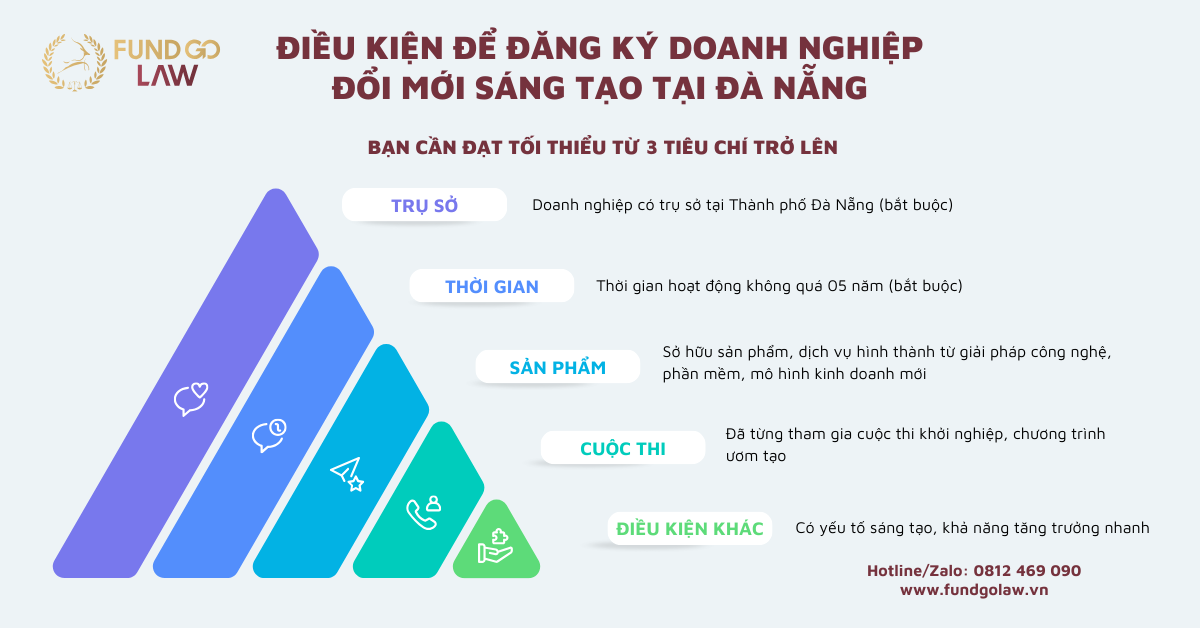

Requirements for registering an innovative enterprise

- Businesses headquartered in Da Nang City (mandatory)

- Operating period not exceeding 05 years (mandatory)

- Own products and services created from technological solutions, software, and new business models

- Creative elements, rapid growth potential

- Have participated in startup competitions and incubation programs

To register as an innovative enterprise, you must meet at least three criteria. Among these, having a headquarters in Da Nang City and having been in operation for no more than five years are mandatory requirements.

Required procedures

To increase your chances of approval, you need to prepare all procedures thoroughly and accurately. The application includes:

- Document requesting confirmation of innovative startup activities and innovative startup support activities according to the template;

- A copy of the business registration certificate or the organization establishment certificate;

- Supporting documents: Certified copies of intellectual property protection certificates or certified copies of decisions recognizing the results of scientific research, technological development, or certified copies of other documents certifying projects involving innovation in products, services, technology, or new business models; or a certified copy of an award certificate from innovation startup competitions and science and technology awards in accordance with the law on science and technology awards;

- Describe the activities of the organization/business using the template;

- Other relevant supporting documents (if any).

The process of registering an innovative business with FundGo Law

- Provide detailed advice on the conditions for registering innovative enterprises under Resolution 53/2024/NQ-HĐND, propose registration options suitable for the characteristics of each enterprise;

- Prepare a set of documents confirming innovative activities in accordance with the model Resolution;

- Representatives submit applications, liaise with the Review Board, and monitor procedures.;

- Support businesses in preparing explanatory reports for the board;

- Receive the results and hand over all relevant documents to the company;

- Guide for businesses to maximize tax exemption benefits.

The application review period is 30 days from the date of submission of a complete application. After successful registration, the enterprise will receive a Confirmation Letter of Innovative Startup Activities and Innovative Startup Support Activities from the Department of Science and Technology.

Fastest innovative business registration service in Da Nang

Do you want to be recognized as an innovative enterprise, enjoy tax exemptions, and receive capital support? Contact Fundgo Law – we are proud to have directly supported 7 of the first 10 enterprises recognized as innovative enterprises in Da Nang.

With in-depth experience and a thorough understanding of the application review and approval process, Fundgo Law assists businesses in:

- Prepare documents correctly and get them approved quickly.;

- Maximize the use of support policies on taxes, capital, and infrastructure;

- Ensure solid legal compliance and long-term support after recognition.